I. Introduction

Based on 2025 industry data, this article systematically analyzes the latest changes in the excavator market. You will understand the reasons for market growth stagnation, the significant decline in domestic production, and the notable differentiation among Chinese brands while they maintain a dominant position in the excavator market share.

II. Overall Russia Excavator Market Trends

2022-2023: Rapid Growth Phase

In 2022, the scale of the excavator market surpassed the historical peak of 2008. From January to September 2023, sales reached 11,766 units, a 55% year-on-year increase, setting the highest record in the post-Soviet era.

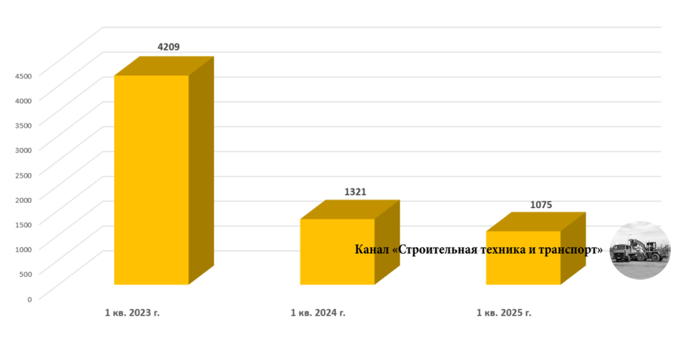

2024-2025: Growth Stagnation Phase

Starting in 2024, market growth momentum reversed, with import volumes beginning to decline. The main reason is the Russian Central Bank’s maintenance of high benchmark interest rates, leading to reduced investment in the construction industry and decreased market demand.

II. Russia Domestic Excavator Production Situation

1. Significant Decline in Production

From January to September 2025, Russia excavator production was only 264 units, a sharp year-on-year decrease of 56%.

2. Performance of Major Enterprises

- UMG Tver Excavator Plant: 58 units produced, an 84% year-on-year decrease

- UMG Exmash Plant: 200 units produced, a 10% year-on-year decrease

- Ivanovo Crane and Excavator Plant: Only 6 units assembled, a 78% year-on-year decrease

3. Changes in Excavator Market Share

The market share of domestically manufactured Russia excavator decreased from 12% in 2024 to 8% in the first quarter of 2025, far below the 28% level in 2008.

III. Import Market Analysis

1. China Excavator Brands: Accounting for 74% of Import Share with Significant Internal Divergence

From January to March 2025, the top three brands by import volume were all China excavator manufacturers:

- Sany excavator : 234 units imported, a 6% year-on-year decrease

- Shantui excavator: 112 units imported, a 51% year-on-year decrease

- SDLG excavator: 109 units imported, a 22-fold year-on-year increase

Import details of other major China excavator manufacturers are as follows:

- LiuGong excavator: 54 units, a 29% year-on-year decrease

- Zoomlion excavator: 51 units, a 34% year-on-year increase

- Lovol excavator: 45 units, a 69% year-on-year decrease

- XCMG excavator: 38 units, a 45% year-on-year decrease

- Sunward excavator: 29 units, a 44% year-on-year decrease

In addition, dozens of other China excavator brands collectively imported 240 units, a 20% year-on-year decrease. During the same period, Russia also imported 1 Cheltra branded excavator from China

2. Korean Excavator Brands: Hyundai Defies Market Downturn

- Hyundai: imported 162 units, a year-on-year increase of 24%.

- Develon: imported 84 units, a year-on-year decrease of 36%.

3. Other Developments

- Hitachi and other brands collectively imported 33 units.

- Used excavator imports totaled 25 units, a year-on-year increase of 108%.

IV. Latest Market Dynamics: Policy Changes Trigger Export Volatility

1. Russia Becomes China’s Top Excavator Export Market

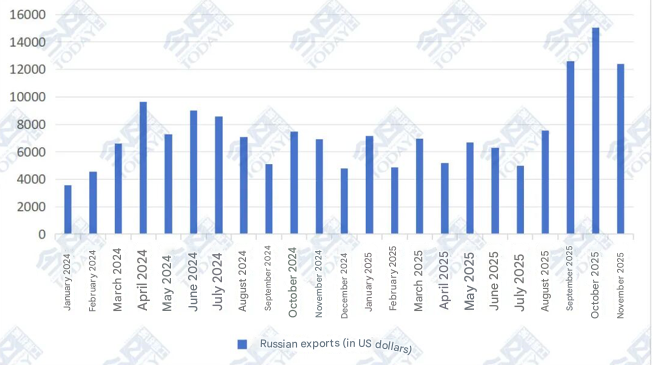

Since September 2025, Russia has surpassed Indonesia for three consecutive months to become China’s largest excavator export destination. This change is closely related to policy adjustments by the Russian government, significantly impacting the excavator market share.

2. Export Performance Data

- October 2025: Exports to Russia reached $150.3463 million

Set a new record for monthly exports to a single country in the past two years

Month-on-month growth of 19.39%, year-on-year increase of 101.46% - November 2025: Exports reached $124.0926 million

Month-on-month decrease of 17.46%, but still a year-on-year increase of 79.09%

3. Adjustment of Russia Machinery Scrapping Tax Rate Policy

- Equipment cleared through customs before December 31, 2025: Applicable old tax rate

- From January 1, 2026: Applicable new tax rate (significant tax rate increase with no transition period)

V. Market Response and Future Outlook

1. Supply Chain Accelerates in Response to Policy Changes

Facing the upcoming implementation of Russia’s new machinery scrapping tax rate policy, the China-Russia engineering machinery industry chain has fully activated the “rush export” mode. China excavator manufacturers are expanding production capacity and accelerating shipments to Russian ports, while Russian importers are racing against time to complete the entire process from order placement to logistics and customs clearance, striving to complete clearance before December 31, 2025 to apply the old tax rate.

2. Industry Impact Analysis

The Russia excavator market will focus on promoting localization of engineering machinery production in the future, with market competition gradually returning to rational normality. Clear tax policies will stabilize supply-demand relationships and promote standardized industry development, affecting the strategic layout of China excavator manufacturers in the Russian excavator market.

VI. Conclusion

The 2025 Russia excavator market has entered an adjustment phase following rapid growth, with declining demand challenging domestic manufacturers. Chinese brands maintain strong excavator market share through supply chain advantages, reinforced by record export performance. Future Russia excavator market dynamics will be shaped by policy changes and competition, requiring continued monitoring of evolving market share patterns.

As a professional China excavator manufacturer, WALMACH offers a comprehensive range of excavator products. Should you have any requirements or questions regarding construction machinery, please feel free to contact us.