I. Introduction

This analysis systematically examines the 2025 China excavator sales performance, detailing export growth and regional demand for both crawler and wheeled models across major markets. It further profiles leading China excavator manufacturer, including SANY, XCMG, and LiuGong, highlighting their technological strengths and the industry’s evolution from volume-driven excavator export to technology-led, solution-oriented growth, demonstrating enhanced global competitiveness.

II. Overview of China Excavator Export Data from January to November 2025

According to the latest data from the General Administration of Customs, China excavator exports continued to show strong growth momentum in 2025:

Overall Export Performance:

From January to November, cumulative exports of excavators (including crawler excavator and wheel excavator) reached 281,642 units, with a total export value of $9.4 billion, representing year-on-year increases of 35.85% and 26.43%, respectively.

Highlight for November:

Both crawler excavator and wheel excavator exports in November achieved year-on-year growth rates exceeding 50%, demonstrating strong growth momentum in the global excavator market.

III. In-Depth Analysis of Crawler Excavator Exports

1. Overall Performance

November 2025: Exports of 27,752 units, valued at $872 million, with year-on-year growth rates of 52.36% and 26.67%, respectively.

January-November Cumulative: Exports of 274,010 units, valued at approximately $9.1 billion, representing year-on-year growth of 35.19% and 26.34%.

Coverage: 210 countries and regions.

2. Market Growth Trend

The excavator export market for crawler excavator has shown a stable growth trend since 2025, with expanding growth rates. The single-month export growth rate in November (over 50%) was significantly higher than the cumulative growth rate (35%), indicating strong momentum for sustained “high growth.”

3. Crawler Excavator Major Export Markets

(Based on Cumulative Exports from January to November)

Exports of crawler excavators from January to November 2025

| Trading Partner Name | Quantity (units) | Amount (US$ 10,000) | Unit Price per Unit (US$ 10,000) | Average Tonnage (tons) | Rank by Amount |

|---|---|---|---|---|---|

| Indonesia | 18578 | 90855 | 4.89 | 16.3 | 1 |

| Russia | 7619 | 80996 | 10.63 | 27.2 | 2 |

| Belgium | 14372 | 56075 | 3.9 | 7.9 | 3 |

| Guinea | 2635 | 34633 | 13.14 | 40.1 | 4 |

| Philippines | 6377 | 29718 | 4.66 | 16.3 | 5 |

| United States | 54322 | 28864 | 0.53 | 1.6 | 6 |

| Mali | 1872 | 27487 | 14.68 | 43 | 7 |

| Turkey | 4346 | 25625 | 5.9 | 17.6 | 8 |

| Saudi Arabia | 3053 | 21880 | 7.17 | 26.1 | 9 |

| Brazil | 6209 | 21699 | 3.49 | 9.6 | 10 |

| Netherlands | 5126 | 20180 | 3.94 | 6.7 | 11 |

| United Arab Emirates | 3242 | 18421 | 5.68 | 21.9 | 12 |

| South Africa | 1830 | 17663 | 9.65 | 30.4 | 13 |

| Malaysia | 3848 | 17584 | 4.57 | 17.6 | 14 |

| Vietnam | 6869 | 16224 | 2.36 | 16.5 | 15 |

| Ghana | 1612 | 14366 | 8.91 | 26.5 | 16 |

| Australia | 6179 | 13687 | 2.22 | 5 | 17 |

| Kazakhstan | 3826 | 13661 | 3.57 | 12.3 | 18 |

| Algeria | 1353 | 13124 | 9.7 | 26.5 | 19 |

| Côte d'Ivoire | 1114 | 13087 | 11.75 | 37.9 | 20 |

Top Five Countries/Regions by Export Volume:

United States – 54,322 units (topping the list, nearly three times the second-place country)

Indonesia – 18,578 units

Belgium – 14,372 units

Germany – 14,144 units

Canada – 9,448 units

Note: From January to November, four countries/regions exceeded 10,000 units in exports, while 15 countries/regions exceeded 4,000 units.

November Month-over-Month Highlights:

Significant Month-over-Month Growth: Brazil, Italy, Vietnam (growth exceeding 100%), as well as Belgium, Australia, and France.

Month-over-Month Decline: United States, Indonesia, Russia, Canada, with exports to Russia dropping over 30% month-over-month, and exports to Germany declining over 70% month-over-month.

4. Crawler Excavator Export Value Analysis

The total export value of the top twenty countries/regions reached $5.76 billion, accounting for 64.49% of the total.

Top Export Value: Indonesia ($910 million)

Other High-Value Markets: Russia ($810 million), Belgium ($560 million)

Noteworthy Observation: The United States leads significantly in quantity, but ranks only seventh in value, suggesting its imports may favor mid-to-low-end or smaller excavator from China. In contrast, countries like Russia, Guinea, the Philippines, Mali, Turkey, and Saudi Arabia have value rankings significantly higher than their quantity rankings, indicating a preference for high-end, high-value models in these excavator market.

IV. Performance of Wheel Excavator Exports

1. Overall Data

November 2025: Exports of 741 units, valued at $44 million, with year-on-year growth rates of 60.04% and 74.09%, respectively.

January-November Cumulative: Exports of 7,632 units, valued at $360 million, representing year-on-year growth of 64.48% and 28.61%.

Coverage: 153 countries and regions.

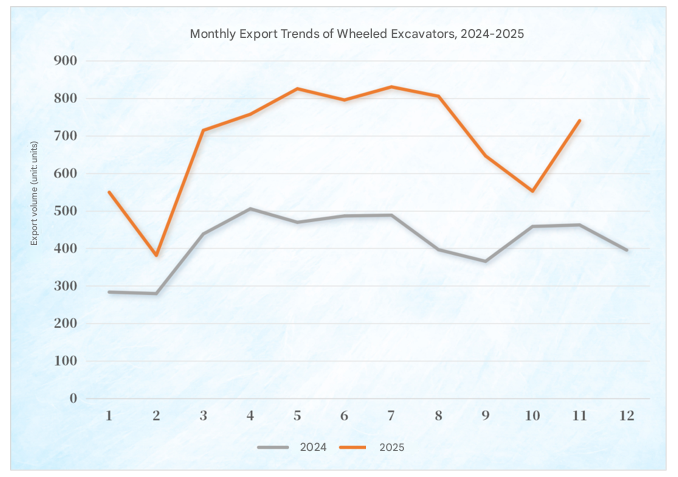

2. Growth Trend

The excavator market for wheel excavator also showed steady growth since 2025, though the growth rate narrowed starting in August. A significant rebound occurred in November, with export volume growth exceeding 60% and export value turning positive year-on-year with growth exceeding 70%.

3. Wheel Excavator Major Export Markets

(Based on Cumulative Exports from January to November)

| Trading Partner Name | Quantity (units) | Amount (US$ 10,000) | Unit Price per Unit (US$ 10,000) | Average Tonnage (tons) | Rank by Amount |

|---|---|---|---|---|---|

| Russia | 933 | 8689 | 9.31 | 18.5 | 1 |

| Uzbekistan | 708 | 3381 | 4.78 | 9.5 | 2 |

| Philippines | 749 | 2985 | 3.98 | 8.7 | 3 |

| Kyrgyzstan | 527 | 2229 | 4.23 | 8.1 | 4 |

| Belgium | 153 | 1847 | 12.07 | 21.3 | 5 |

| Kazakhstan | 366 | 1812 | 4.95 | 13.7 | 6 |

| Vietnam | 578 | 1473 | 2.55 | 8.6 | 7 |

| Brazil | 169 | 1042 | 6.16 | 13.6 | 8 |

| United Arab Emirates | 150 | 954 | 6.36 | 15 | 9 |

| Saudi Arabia | 114 | 903 | 7.92 | 17.6 | 10 |

| Pakistan | 475 | 789 | 1.66 | 13.3 | 11 |

| Indonesia | 184 | 698 | 3.79 | 8.8 | 12 |

| Poland | 90 | 640 | 7.11 | 14.6 | 13 |

| Belarus | 71 | 610 | 8.59 | 19.1 | 14 |

| Thailand | 99 | 539 | 5.45 | 11.7 | 15 |

| Tajikistan | 88 | 416 | 4.73 | 13 | 16 |

| Morocco | 42 | 391 | 9.31 | 16.9 | 17 |

| Germany | 369 | 387 | 1.05 | 1.9 | 18 |

| Algeria | 31 | 322 | 10.38 | 16.3 | 19 |

| Guinea | 27 | 266 | 9.87 | 16.2 | 20 |

Top Six Countries/Regions by Export Volume:

Russia – 933 units

Philippines – 749 units

Uzbekistan – 708 units

Vietnam – 578 units

Kyrgyzstan – 527 units

Pakistan – 475 units

Note: From January to November, five countries/regions exceeded 500 units in exports, while 14 countries/regions exceeded 100 units.

November Month-over-Month Highlights:

Significant Month-over-Month Growth: Uzbekistan, Kazakhstan, Myanmar, Brazil (growth exceeding 100%), as well as Russia, Kyrgyzstan, and Vietnam.

Month-over-Month Decline: Only the Philippines (decline exceeding 30%).

4. Wheel Excavator Export Value Analysis

The total export value of the top twenty countries/regions reached $300 million, accounting for 83.38% of the total.

Top Export Value: Russia ($87 million)

Other High-Value Markets: Uzbekistan ($34 million), the Philippines, and Kyrgyzstan (both exceeding $20 million)

V. Overview of Top Chinese Excavator Manufacturers and Their Advantages

As excavator from China continues to gain global market share, major China excavator manufacturer have become key drivers of excavator export growth, leveraging technological accumulation, cost-effective products, and a global service network. Below are some leading Chinese excavator manufacturers and their areas of expertise:

1. SANY Heavy Industry

- Key Strengths: Full range of excavators, with particular leadership in large and extra-large excavators and intelligent excavators.

- SANY Excavator Technical Features: Intelligent electronic control systems, energy-saving technologies, remote monitoring, and fault diagnosis systems.

- Export Focus: Medium to large crawler excavator, with increasing market share in Europe, North America, and Belt and Road Initiative countries.

2. XCMG Group

- Key Strengths: Full range of excavators, specializing in heavy-duty and mining excavators.

- XCMG Excavator Technical Features: High-strength structural design, efficient hydraulic systems, and durability for harsh working conditions.

- Export Focus: Large crawler excavator and mining equipment, performing strongly in markets like Russia, Southeast Asia, and Africa.

3. LiuGong

- Key Strengths: Small and medium-sized excavators and wheel excavator.

- Liugong Excavator Technical Features: Flexibility, compatibility with multifunctional attachments, and high fuel efficiency.

- Export Focus: Wheel excavator and small crawler excavator, popular in Southeast Asia, Central Asia, and Eastern Europe.

4. Zoomlion

- Key Strengths: Intelligent excavators and new energy excavators.

- Zoomlion Excavator Technical Features: Electrification technology, intelligent construction solutions, low noise, and low emissions.

- Export Focus: Medium to large intelligent excavators, promoting electric products in environmentally conscious European markets and emerging markets.

5. Sunward Intelligent Equipment

- Key Strengths: Small excavators and specialized excavator equipment.

- Sunward Excavator Technical Features: Compact design, quick-change multifunctional attachments, and high cost-effectiveness.

- Export Focus: Small crawler excavator and wheel excavator, holding a certain market share in gardening, municipal engineering, and developing countries.

6. SDLG (Shandong Lingong Construction Machinery)

- Key Strengths: Economical small and medium-sized excavators.

- Technical Features: High reliability, easy maintenance, and low total cost of ownership.

- Export Focus: Small and medium-sized crawler excavator, competitive in price-sensitive markets like Africa, South Asia, and the Middle East.

7. WALMECH

- Key Strengths: small and medium-sized excavators.

- Technical Features: Modular design for easy maintenance, focus on fuel efficiency and operational flexibility, and multifunctional quick-attach systems on some models.

- Market Performance: Rapid excavator export growth in recent years, primarily targeting price-sensitive and flexible emerging markets in Southeast Asia, Africa, and the Middle East, recognized for high cost-effectiveness and adaptable products.

VI. Conclusion of China Excavator Market

From these trends, it is evident that the China excavator sales industry is undergoing a quiet but profound transformation—from simply selling products to providing integrated solutions, and from relying on price advantages to winning markets through technology and service. This transformation may be even more noteworthy than the growth in excavator export data.

The excavator market is witnessing China excavator evolve from basic machinery exports to sophisticated technology solutions, with China excavator manufacturer leading this global shift through innovation and strategic market expansion.