The hydraulic excavator, as a complex piece of engineering equipment integrating mechanical, hydraulic, and electronic technologies, not only represents the strength of modern industry but also serves as a barometer for global infrastructure development. This article will start with its basic principles, delve into the leading excavator manufacturers such as Caterpillar, Komatsu, and Sany, Volvo and explore the 2025 market segmentation, competitive landscape, and future trends.

I. What is a Hydraulic Excavator?

A hydraulic excavator is a self-propelled engineering machine that uses a hydraulic transmission system to drive working devices (such as the boom, arm, and bucket) for excavation and loading operations.

1.1 Excavator Main Components

Excavator Undercarriage:

Provides mobility, mainly divided into tracked excavator (better stability, most widely used) and wheeled excavator (higher mobility, suitable for urban applications).

1.2 Hydraulic Excavator Working Principle

The diesel engine (or electric motor) drives the hydraulic pump to generate high-pressure hydraulic fluid. This fluid is then distributed via control valves to hydraulic cylinders and motors, enabling precise control of the arm’s extension, lifting, slewing, and travel.

1.3 Hydraulic Excavator Key Features

Compared to older mechanical excavators, hydraulic transmission offers greater power, smoother control, and higher operational efficiency, making it the absolute mainstream in modern excavators.

II. Excavator Market Segmentation: Analysis by Tonnage and Application

2.1 Excavator Segmentation by Tonnage

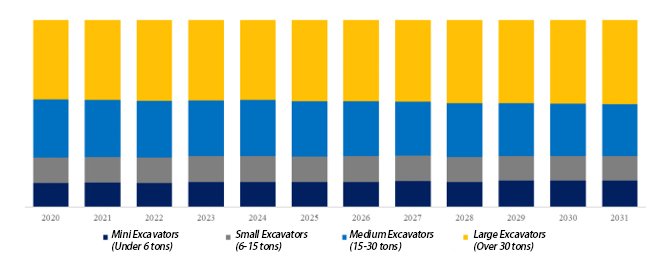

Micro Excavator (0–6 tons), Small Excavator (6–15 tons), Medium Excavator (15–30 tons), Large Excavator (>30 tons)

Micro and small excavators are the most widely used, accounting for approximately 60.91% of global sales in 2025.

Large excavators dominate in market value due to their higher unit price, holding about 43.4% of the global excavator market share in 2025, while small units represent only 26.86%.

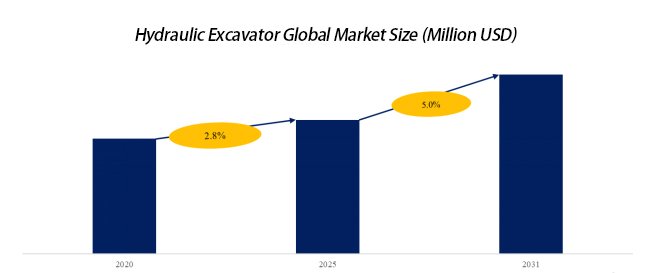

2.2 Excavator Global Market Size Forecast

The global hydraulic excavator market is projected to reach USD 65.9 billion by 2031, with a CAGR of 5.0%.

2.3 Excavator Major Application

Construction/real estate, public utilities, mining and oil wells (the largest application segment, holding 36.8% share in 2025), and road/port construction.

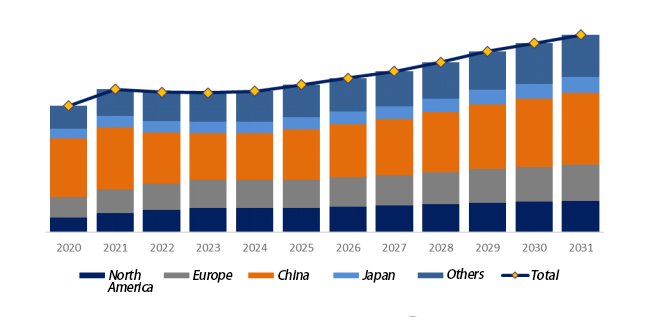

III. Regional Market Landscape: Asia-Pacific Leads Growth

3.1 Asia-Pacific Region

The fastest-growing area globally in recent years. In 2025, China alone accounted for about 34.29% of global consumption, expected to rise to 35.68%.

3.2 Excavator Major Producing Countries

The U.S., EU, Japan, China, and South Korea.

China excavator produces approximately 40% of global output, hosting factories of many international excavator manufacturers for both complete machines and components.

3.3 Growth Potential

Infrastructure development in emerging economies like China and India will be key future drivers.

IV. Global Competitive Landscape: Dominance of Major Excavator Brands

4.1 High Market Concentration

The top five excavator suppliers (Caterpillar, Hitachi Construction Machinery, Sany, Komatsu, XCMG) held over 50.9% of the market share in 2025.

1) Caterpillar

- Country: USA

- Caterpillar Founded: 1925

- Caterpillar Key Product Strengths:

Large and medium excavators

Ultra-large mining excavators

Wheel loaders and bulldozers

Engines and power systems

2) Hitachi Construction Machinery

- Country: Japan

- Hitachi Founded: 1970

- Hitachi Key Product Strengths:

Medium to large hydraulic excavators

Ultra-large mining excavators

Wheel loaders

Compact excavators

3) Sany

- Country: China

- SANY Founded: 1989

- SANY Key Product Strengths:

Full range of hydraulic excavators

Concrete machinery (globally leading)

Crane machinery

Piling machinery

4) Komatsu

- Country: Japan

- Komatsu Founded: 1921

- Komatsu Key Product Strengths:

Large mining excavators

Bulldozers (globally leading)

Dump trucks

Wheel loaders

5) XCMG

- Country: China

- XCMG Founded: 1989

- XCMG Key Product Strengths:

Full range of hydraulic excavators

Crane machinery (globally leading)

Road machinery

Concrete machinery

4.2 Other Key Excavator Manufacturer

6) Volvo Construction Equipment

- Country: Sweden

- Volvo Founded: Construction Equipment division established in 1995

- Volvo Key Product Strengths:

Small to medium excavators

Wheel loaders

Articulated trucks

Compact equipment

7) Kobelco Construction Machinery

- Country: Japan

- Kobelco Founded: 1930

- Kobelco Key Product Strengths:

Medium excavators

Ultra-large excavators

Small excavators

Backhoe loaders

8) CASE Construction Machinery

- Country: USA (now part of Italy’s CNH Industrial Group)

- Case Founded: 1842

- Case Key Product Strengths:

Small to medium excavators

Wheel loaders

Bulldozers

Skid steer loaders

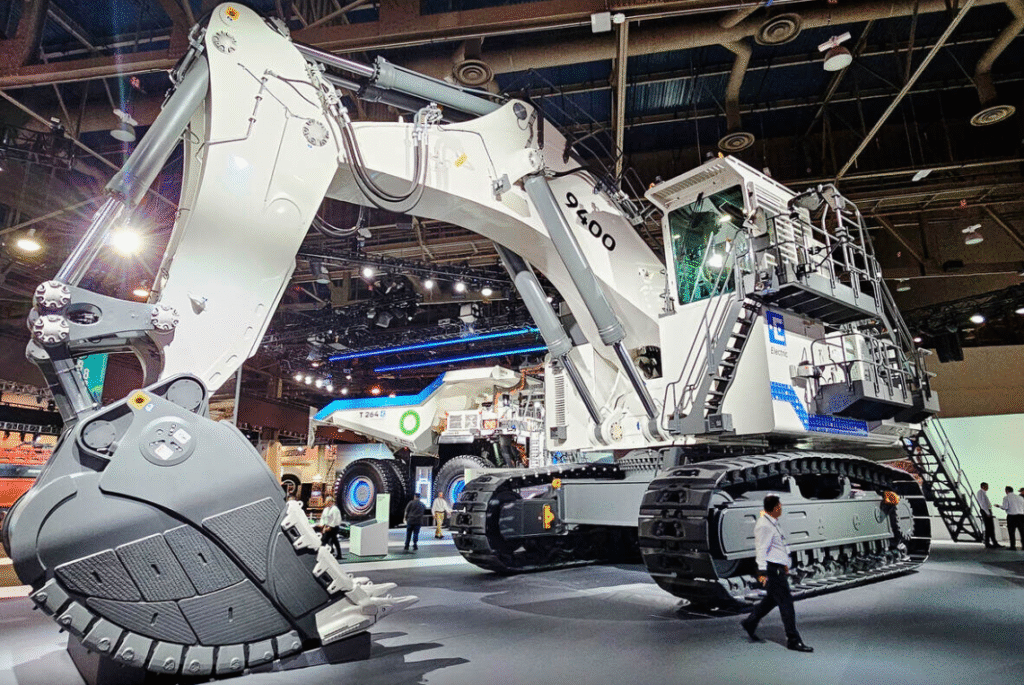

9) Liebherr

- Country: Germany

- Liebherr Founded: 1949

- Liebherr Key Product Strengths:

Large mining excavators

Crawler cranes (globally leading)

Wheel loaders

Concrete technology equipment

10) Develon

- Country: South Korea

- Develon Founded: 1937

- Develon Key Product Strengths:

Medium excavators

Wheel loaders

Compact equipment

Attachment tools

11) WALMACH

- Country: China

- WALMACH Founded: 2003

- WALMACH Key Product Strengths:

Small to medium excavators

Road construction machinery

Bulldozers

Full hydraulic road rollers

V. Market Drivers and Future Outlook

5.1 Key Drivers

- Increasing investment in infrastructure by both private construction firms and governments.

- Large-scale projects in oil & gas, mining, and transportation boosting demand.

- Rapid urbanization and industrialization in developing countries.

5.2 Future Trends

- The market remains dynamic, especially in developing regions.

- Innovation in electrification and intelligent solutions may reshape the industry landscape, with major excavator manufacturers investing heavily in R&D.

- Sustainability requirements are pushing for higher energy efficiency and eco-friendly designs across all excavator brands.

VI. Conclusion

In the coming years, the excavator market is expected to continue growing, especially in the Asia-Pacific region, driven by infrastructure investment, accelerated urbanization, and technological innovation. Key manufacturers, including Caterpillar, Komatsu, Sany, and WALMACH, are continually adapting to market demands, focusing on research and development of sustainable and intelligent solutions. These trends will not only reshape the landscape of brands but also enhance the energy efficiency and environmental performance of excavators, laying a solid foundation for future infrastructure development.